The bosses of Norway’s biggest bank, DNB, were being accused of virtually thumbing their noses at their own employees, their customers and hundreds of thousands of other workers in the country this week. News that DNB chief executive Rune Bjerke and his management team were collectively pocketing a 30 percent pay hike, largely in the form of bonuses, could hardly have come at a worse time.

The bonus news broke just as Norway’s biggest employer and labour organizations had settled down for annual pay and benefit negotiations that are expected to be tough. Workers have already been told, even by their own unions, that they shouldn’t expect raises of more than 3 percent, possibly less, because even some union leaders worry that relatively high wages in Norway threaten the competitiveness of their employers. There also are concerns of an economic slowdown and rising unemployment, while some workers face not only lower wage growth but possible pay cuts because of global competition.

At the same time, there are serious disagreements between the labour and employer organizations over such key issues as pension programs, the benefits of which have been dramatically reduced in recent years, and overtime rules. Businesses including DNB are constantly trying to do more with less people, and it was only last year that DNB’s Bjerke told newspaper Aftenposten that his employees, in an uproar over a controversial reorganization, “must tolerate that we operate more efficiently, shareholders must tolerate lower dividends and (loan) customers must live with higher interest rates.”

‘Collective effort’ under fire

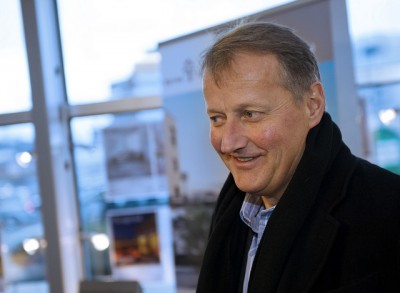

Bjerke’s comments came as he tried to justify DNB’s controversial decision last year to raise mortgage rates, ostensibly to meet new state capital requirements for banks, even though Norway’s central bank was keeping rates historically low. Bjerke, a long-time member of the Labour Party who’s married to Labour politician Libe Rieber-Mohn, called his plans for higher interest rates and cost control within the bank a spleiselag, a Norwegian term for a collective effort, to keep DNB strong.

One year later, DNB has reported record high profits, paid out even higher dividends to shareholders (which includes the Norwegian state) and had to reveal that Bjerke and his management team received generous bonuses and pay hikes. Bjerke’s own bonus amount to NOK 2.17 billion (USD 362,000) in addition to annual compensation of NOK 5.26 million. Newspaper Dagsavisen reported that the increase in Bjerke’s bonus amounted to 26.6 percent.

Not commenting now

Bjerke refused to comment on the steep rise in his own compensation, leaving the bank’s communications chief Even Westerveld to explain why management seemingly did not practice what it preached.

Westerveld claimed that Bjerke’s actual fixed compensation (lønn in Norwegian) rose by just 3.4 percent while it rose 3.9 percent for DNB employees in general. He also noted that Bjerke’s total compensation as head of the country’s biggest bank is much lower than that paid in other countries. That’s an argument often used when defending executive pay levels in Norway, even though many Norwegians retort that executive pay abroad is outrageously high, contributes to social disparity and can’t be defended, especially in a social welfare state like Norway.

Many media outlets also noted that Bjerke’s total compensation package of NOK 7.7 million compares to the NOK 1.5 million earned by Prime Minister Erna Solberg. Even though public sector pay is traditionally much lower than private sector pay, commentators questioned whether Bjerke, as head of a bank that was bailed out by the state just over 20 years ago, receives too much.

‘Vulgar’

“It’s vulgar to pay a bank boss so much,” claimed Snorre Valen, a Member of Parliament on its finance committee for the Socialist Left Party. “DNB can’t think that such pay policies won’t damage the bank’s reputation, and it’s selfish for Bjerke to accept it (his bonus). This kind of executive pay undermines the bank’s contract with society.”

Labour Party MP and fellow finance committee member Marianne Marthinsen agreed, slamming her own party fellow by blasting his compensation as well. “DNB generated a profit of NOK 17.5 billion last year, without it being shared with customers through lower interest rates,” Marthinsen pointed out. The profits and executive pay are also fueling an effort by Norway’s consumer council, Forbrukerrådet, to get DNB customers to move their accounts to other banks.

Other Labour comrades unhappy, too

Gerd Kristiansen, leader of Norway’s powerful trade union federation LO, also lashed out at Labour Party member Bjerke. “Employers talk about the need for wage moderation, but then give themselves gold-plated compensation packages,” Kristiansen told Dagsavisen. “It provokes ordinary employees who are on the verge of this year’s wage settlements.”

Norway’s competition authority, Konkurransetilsynet, is also concerned about the banks’ failure to lower interest rates while generating huge profits. It is launching a survey to evaluate competition among banks in Norway, not least since many of them followed DNB’s lead last year and raised lending rates while leaving interest rates on savings deposits at record low levels. The banks’ margins have thus “increased considerably” during the past year, the authorities noted.

newsinenglish.no/Nina Berglund